- Tel: (+1) 800-606-0772

- Lun → Vie : 10am-5pm

- Email: info@plusmoreusa.com

NEW VARIANT OF THE COVID-19 VIRUS

UPDATE FOR 2021

The American Rescue Plan Act changed the sick leave and family leave credit for certain workers such as independent contractors or freelancers for 2021. The government extended the 2020 sick leave credit through March 31, 2021 and added a new sick leave credit starting in April. September 1, 2021 to September 30, 2021.

TAX CREDIT

Dollar for dollar money that belongs to you, if you qualify, and you don’t have to give it back to the government . Whether or not you filed your 2021 tax return, you still have the opportunity to claim thousands of dollars that may belong to you.

STEP ONE

CHECK YOUR TAX FILING

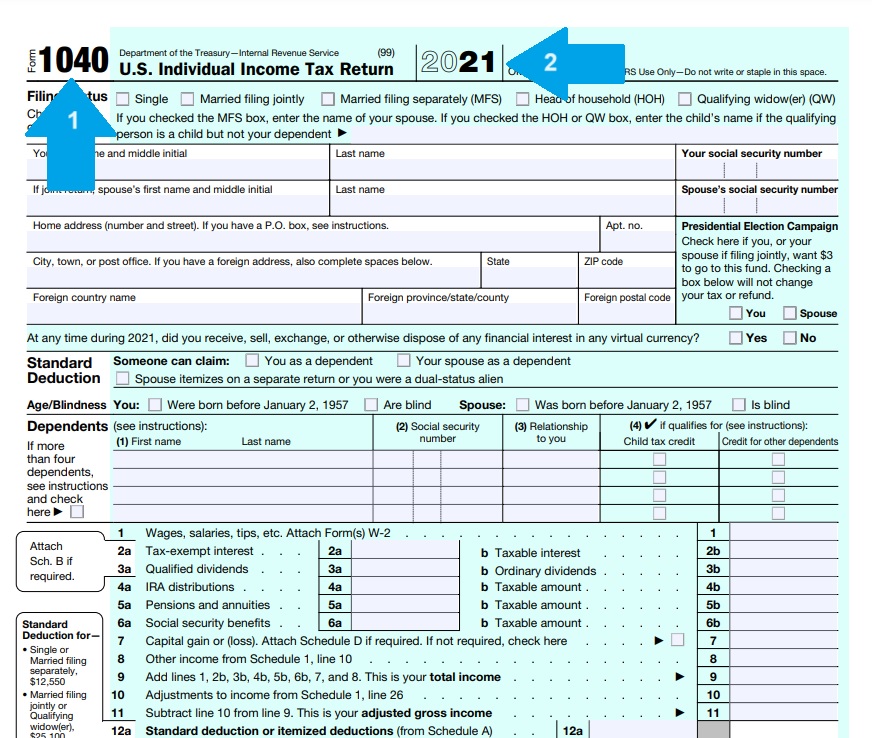

2021 IRS TAX FORM 1040

Make sure you are checking the correct year (see image, arrow 2) on your personal return 1040 form (see image, arrow 1).

STEP TWO

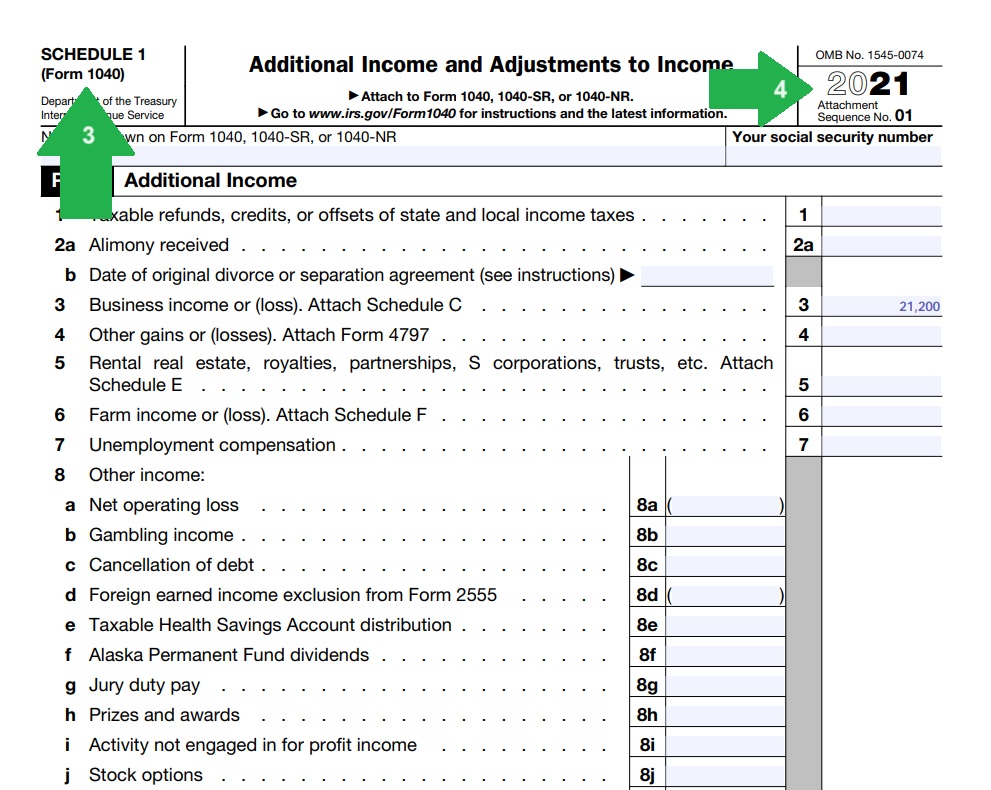

SCHEDULE 1

2021 1040 FORM- schedule 1

Review your form or Schedule 1 (see arrow image 3) added to your 2021 personal return (see arrow image 4). If you have a positive amount on line 3, this indicates that you had profits and qualify for the covid-19 tax credit.

STEP THREE

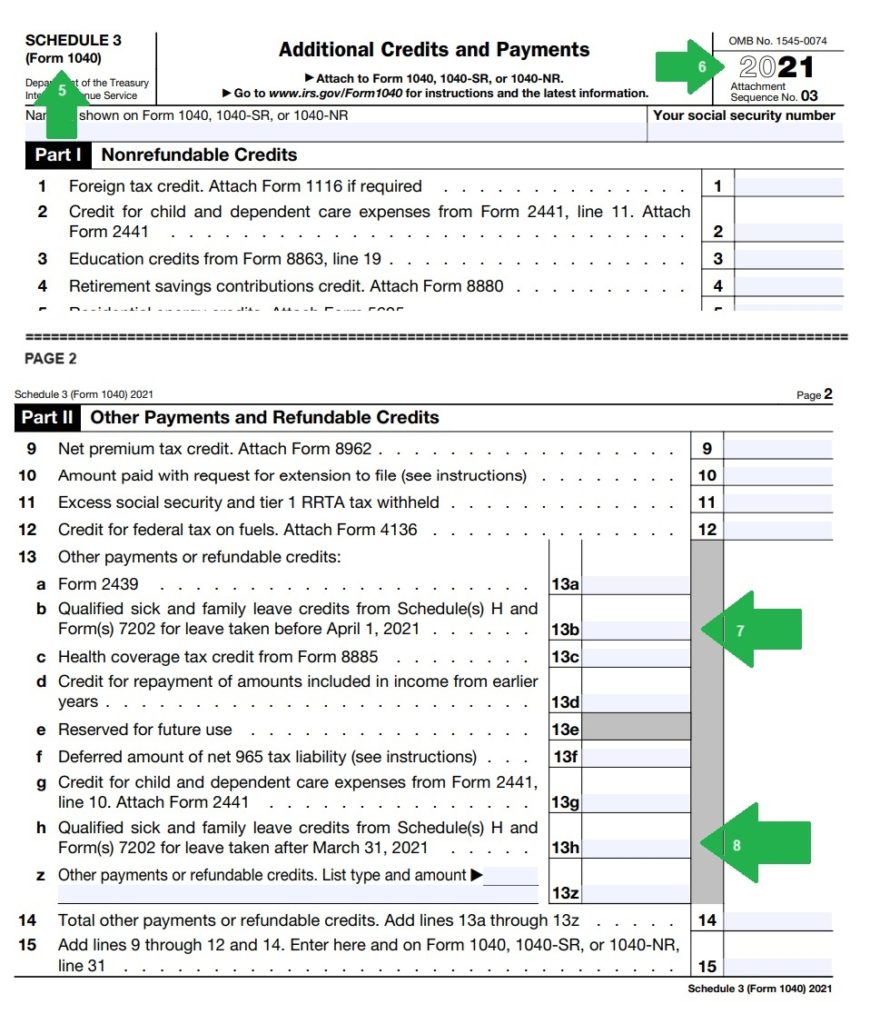

SCHEDULE 3

2021 1040 FORM- schedule 3

In your return, you will find the form or Schedule 3 (see image, arrow 5) for the year 2021 (see image, arrow 6). On the second page or Part Two (Part II), check lines 13h and 13h. If you do not have any amount in any of those lines, your credit was not collected.

CLAIM YOUR CREDIT

- 13538 Village Park Dr, Suite 265, Orlando, FL 32837

- 1.800.606.0772

- info@plusmoreusa.com

- 1.407.319.1306

Conectate con nosotros

© 2018-2022 PlusMoreUsa Financial & Marketing Services LLC.